Business Description

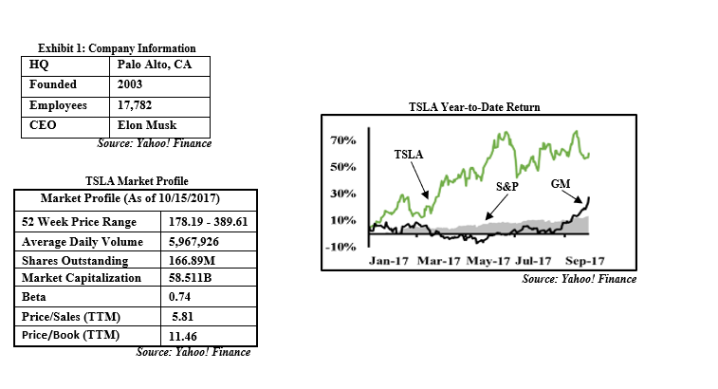

Company: Tesla, Inc. (NASDAQ: TSLA) is an American auto manufacturer with additional operations that include Energy Storage and Solar Panel Manufacturing headquartered in Palo Alto, California. In the words of the company’s CEO ‘Elon Musk’, its goal is “to accelerate the advent of sustainable transport by bringing compelling mass market electric cars to market as soon as possible.” In other words, Tesla manufactures and sells high-quality, affordable, fully electric cars. Tesla is the number one full electric vehicle seller in the world and it is the only car manufacturer that sells exclusively fully electric vehicles. Other than typical car manufacturers, Tesla’s operations include the generation and storage of energy products. This makes Tesla the only vertically-integrated car manufacturer and energy company in the world, as Tesla offers end-to-end energy products and has built a global network of vehicle stores, service centers and Supercharger stations with the purpose of accelerating the widespread adoption of their products.

Products: Tesla’s products and services can be broken down in three categories: vehicles, energy storage, and solar energy systems. The following is a description of Tesla’s products:

Vehicles (82%): The bulk of Tesla’s revenue comes from distributing fully electric vehicles. The company currently manufactures and sells three electric vehicles models: the Model S, Model X, and Model 3. Model S is a sedan of which deliveries started in June 2012. Model S is the only fully electric vehicle in the world that can compete in the luxury and performance segments of the automotive industry. The first Model X was delivered in the third quarter of 2015 and Tesla describes Model X as “the longest range all-electric […] sport utility vehicle in the world and offers exceptional functionality with high performance features.” The National Highway Safety Administration awarded both Models S and X the highest safety rating for cars. Model 3 is the most recently announced model. The first deliveries were made on July 28, 2017. Model 3 differs from the other two models in the sense that it is not meant to compete with luxury and performance vehicles, but it is meant to be a compelling, fully electric vehicle designed for the mass market. This allows it to be a more affordable model. Whereas the highest performing Models S and X have an average selling price of $134,500 and $135,500 respectively, the average selling price is only $35,500.

The National Highway Safety Administration awarded both Models S and X with the highest safety rating for cars. Model 3 still needs to be tested in order to receive its safety rating. All models are equipped with Tesla’s ‘autopilot’ function which allows them to steer, change lanes, manage cruise control, and park by itself, i.e. without the driver making adjustments.

Energy Storage: Tesla has been offering energy storage solutions since 2013, but the most notable products include Powerwall 2 and Powerpack. Production for these 2nd generation energy storage solutions started in Tesla’s Gigafactory 1in the fourth quarter of 2016. Powerwall 2 is a 14 kWh rechargeable lithium-ion battery meant to supply homes and small commercial facilities with energy. Powerpack is a 200 kWh system that is suitable for large commercial and industrial facilities. Multiple Powerpack blocks can be grouped together to build MWh and GWh installations. Both energy products are clean and store energy from renewable sources such as solar systems. Tesla also builds batteries for its own vehicles.

Solar Energy Systems: Tesla offers a variety of solar energy systems. These are solar systems that convert sunlight into electricity, energy inverters that convert the output from solar panels to a usable form of electricity compatible with the electric grid, systems that attach solar panels to the roof or ground, and electrical components that connect the energy systems to Tesla’s monitoring device and electric grid. Even though Tesla manufacturers some of the systems’ components itself, most of it is bought from other vendors. Tesla announced the plan for its solar roof; an aesthetically pleasing, fully integrated solar energy system built to power customer homes and commercial buildings. The production of the solar roof started at the end of August, 2017 later in Tesla’s Gigafactory 2.

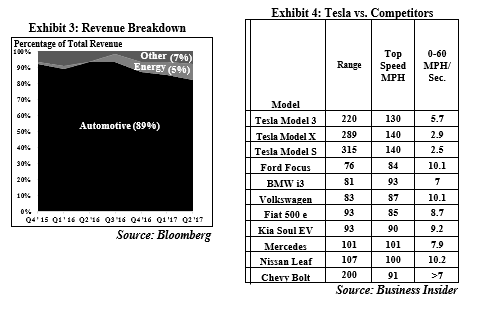

Revenue Breakdown: Today, the automotive segment makes up 82.0% of the company’s revenues and 10.3% consists of energy generation and storage. The other 7.7% is made up by miscellaneous operations. Exhibit 3 is an overview of Tesla’s historical revenue breakdown. Tesla has moved away slightly from their dependence on the automotive segment of their business as Elon Musk believes that ultimately, Tesla is a clean energy solutions company, not just another car manufacturer.

Investment Rationale

Tesla Revolutionizes the EV Industry: Tesla is a one of a kind EV company. It combines performance, efficiency, and pricing to manufacture and sell fully electric cars that outperform the competition on all of these measures. Tesla’s Model 3 is a fully electric vehicle priced at $35,000 that has a maximum speed of 130 mph and accelerates from 0-60 mph in 5.7 seconds. The Mercedes Benz B250 is the second-fastest among Tesla’s competitors with a maximum speed of 101 mph. The second-best model in the EV industry based on acceleration would be the BMW i3 with a 0-60 mph time of 7 seconds. The competitor that has the longest range on one full charge is the Chevrolet Bolt with a range of 200 miles. For Tesla’s model 3, this range is 220 miles. What this indicates is that Tesla has been able to revolutionize the EV industry with a low-cost product that is superior to its competitors on the most important metrics in this market: performance, and efficiency. Models S and X are designed for niche markets, whereas model 3 is designed for the mass market. Models S and X are revolutionary products and serve a market that has been untouched before. Both of these models can compete with models of Ferrari, Porsche, and McLaren on performance. The important difference is that the Tesla models are fully electric and more efficient than the models of the other car manufacturers. Exhibit 4 provides a clear overview of the performance and efficiency of the most popular fully electric vehicles.

Elon Musk Vision: Elon Musk, the CEO of Tesla, is an innovative and ambitious entrepreneur who is looking to make an impact on the future. In an article to CNBC in 2015, Musk was compared to Thomas Edison. This points at the innovative nature of Tesla’s CEO. One of his companies, SpaceX, was the first organization to successfully reuse 70% of a rocket. Never before had a rocket made two return trips to space, but Musk and his company did that. One of the ways in which he is planning to use reusable rockets is to take a million people to the moon over the course of 40 to 60 years. This plan demonstrates how ambition Elon Musk really is. It should be clear that Musk wants to make an impact on the future. That is reflected in Tesla’s mission as well. Its goal is “to accelerate the advent of sustainable transport…” Tesla’s employees believe that their company is making an impact under Musk’s leadership. According to PayScale, 89% of Tesla’s employees think their work makes the world a better place, which is 11% above the next tech-competitor, which is Facebook. There is only one tech-company that scores higher in this category than Tesla. That company is SpaceX. Apparently, Elon Musk knows how to inspire his workforce with his passion to make an impact on the world.

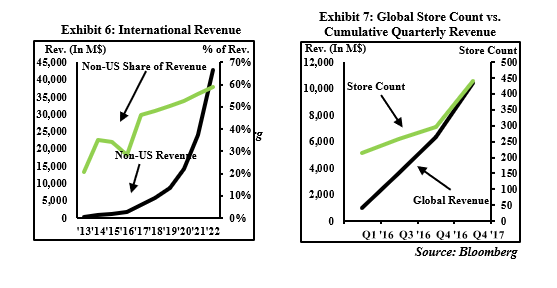

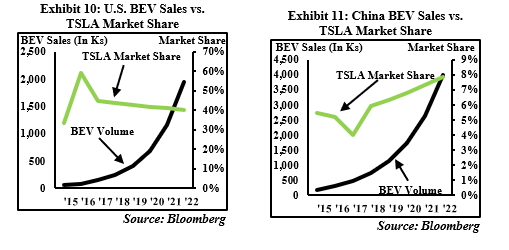

Market Leader in a Promising Industry: The U.S. Electric Vehicle market approximately accounts for 1% of the total U.S. automotive industry. Goldman Sachs estimates that in 2025, the EV market will make up 22% of the U.S. automotive market. In the first 6 months of 2017, Tesla had the largest EV market share in the U.S. with the Model S and X making up 45% of the market. Second was Chevrolet with its Bolt, making up 16%. The range of estimates from IES for the global electric vehicle stock has a mean of approximately 15 million units. At the end of 2016, that stock was 2 million. That would be a 165% CAGR for the period 2016-2020. Tesla has already invested in operations internationally with 45.4% of revenues coming from international sources. Some analysts believe that eventually China will become Tesla’s biggest source of revenue.

Growth Drivers

Model 3: In order to achieve its goal of accelerating the global transition to sustainable transportation, Tesla needed to manufacture a compelling electric vehicle that is accessible for the mass market. The model 3 perfectly fits this description as it has a retail price of $35,000 and it outperforms other electric vehicles currently on the market. Demand for the Model 3 is already there. Between its launch in late July and now there have been made approximately 500,000 preorders at $1,000 for the Model 3. This number is still increasing by a rate of about 1,800 per day. The number of preorders for Model 3 is almost twice as much as the total amount of cars Tesla has sold to date. This shows the impact that a vehicle produced for the mass market has as a future growth driver.

International Expansion: With 44.5% of Tesla’s revenue coming from sources abroad, the company aims to grow out absolute international revenue streams. The largest of Tesla’s charging stations will be built in China, the global leader in the amount of electric vehicles. Additionally, Elon Musk is determined to break through in the Indian market as well, which according to JD Power and Ernst and Young is expected to be the third-largest market for electric vehicles by 2020. Besides these two countries, just in 2017 Tesla has launched in Spain, Jordan, UAE, Portugal, Taiwan, New Zealand, South Korea, and Ireland. China and India in particular will be important potential growth drivers for Tesla. The Chinese EV industry has been said to be Tesla’s main source of revenue in the future and there are good reasons to believe that. Besides China making up more than 40% of the global EV market, Tesla’s presence in China has been increasing. Between 2014 and 2016, revenues from China have increased by 223.3%. In the first 2 quarters of 2017, Tesla’s revenues from China were already at 90.8% of what they were in the entire year of 2016. This indicates that sales from operations in China can be expected to increase significantly in 2017 compared to 2016. Representatives of the Chinese government have reached out to Elon Musk to tell him that China will potentially relax rules for penetration of its EV market by Tesla. When this happens, Tesla’s vehicles would be the only high quality and high performing fully electric vehicles in the biggest and growing EV market in the world. Elon Musk is negotiating with the Indian government as well, which has set a target for having only electric vehicles by 2030.

The Tesla Brand: Tesla’s brand name is already worth more than $4 billion according to Interbrand, which is roughly the same as BMW’s MINI brand. There is also a difference however, which is that Tesla started to sell cars in 2008 and BMW’s MINIs were already sold in 1959. Tesla’s brand is worth so much because it is trendy and eccentric. It is a pioneer in a promising industry, and among all auto manufacturers that sell electric vehicles, no company sells fully electric cars that can match the performance of a Tesla model. The weight that the Tesla brand carries is reflected in its customer loyalty. 91% of Tesla owners said they would buy the same car if they had to do it all over again, which is 7% higher than the next competitor.

Tesla Store Increase: Unlike other auto-manufacturers, Tesla sells its vehicles through its own stores rather than licensed dealerships. They do this because people often dislike the car buying process at dealerships because of the intimidating and high-pressure atmosphere. It would be illegal for car manufacturers to sell cars directly to customers from stores, so Tesla’s stores exist to let people see sample vehicles and their staff educates people about the models rather than trying to pressure them into selling one. If you want to buy a Tesla, you need to order them online. Tesla is still prohibited in states that require customers to buy cars only from licensed dealerships. The amount of states that restrict Tesla’s stores however are decreasing. The result of this trend is that Tesla can open more stores and expose more people to its brand and models. Tesla can continue to expand its network of stores to drive future revenues.

Gigafactories: Tesla says that when Gigafactory 1 is completed, it will be the biggest building in the world. Tesla started the production of the factory in 2014. Production in the Gigafactory 1 started in December 2016. Currently, the gigafactory is used for battery production, but eventually, Tesla wants to move manufacturing of all of its products under the roofs of Gigafactories. Tesla is leasing ‘Gigafactory’ 2 in New York and the future will see more gigafactories both in the U.S. and Europe. The manufacturing of all of Tesla’s products in a few large factories will increase innovation and productivity while reducing average costs. Elon Musk announced that two or three more gigafactories will come to the United States in the next couple of years. Tesla is also planning to build at least one gigafactory in Europe and Asia. Through the use of gigafactories Tesla plans to keep up with the high demand for its products and minimize average costs so that the company can keep competing on price.

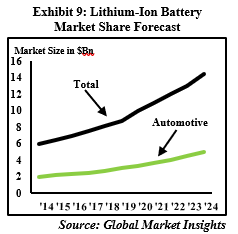

Production: Tesla can start focusing on mass producing their Model 3 now that they have developed an electric vehicle that is meant to serve the mass market. Tesla has set bold production goals. These include producing 5,000 units of model 3 per week by 2017 and 10,000 units per week by the end of 2018. There is a lot of skepticism around these promises because analysts and investors point to the previously missed production targets. The latest one was a miss of production estimates for the Q3 2017. Eventually, these misses in the short term don’t matter and even though they are big in the news, the market realizes that long-term production is more important. Evidence for this is that even when news came out that Tesla missed the Model 3 production target by 82% in Q3 2017, the company’s share price still increased by nearly 2% over the next 24 hours. The long-term production schedule is not unrealistic. Gigafactories will continue to streamline the production process and bottlenecks that can be expected early on in production processes will be removed. The estimated production for Tesla models is graphed in exhibit 8.

New Models: Both Tesla and its CEO are known for their innovative nature. Tesla is the first company to combine efficiency with performance. Arguably, it is the promise of Tesla’s ability to innovate that has led to a year-to-date return of 64%. The newest product that Tesla is currently working on is the world’s first all-electric semi-truck, which is expected to be released on November 16th.

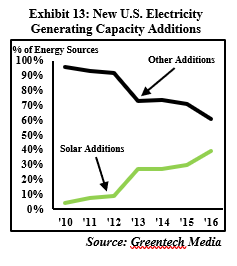

Solar City Acquisition: The acquisition of Solar City made Tesla the world’s first fully integrated energy company. It allows Tesla to generate solar energy on top of its energy storage and sustainable transportation solutions. Globally, according to the report from the IEA solar was the fastest-growing source of new energy, bypassing all other energy sources, including coal. Overall, the IEA found, new solar energy capacity rose by 50 percent globally over 2016. The current growth numbers are far higher than the U.S. Energy Information Administration (EIA) predicted a decade earlier. The agency forecast in 2006 that solar power would amount to only about 0.8 gigawatts of capacity by 2016. Instead, installed solar by 2016 was 46 times that estimate, the NRDC points out. The IEA also increased its forecast for future renewable energy growth, saying it now expects renewable electricity capacity will grow 43 percent, or more than 920 gigawatts, by 2022.

Macroeconomic factors

Because 40% of Tesla’s revenue comes from international sources, Macroeconomic factors will influence the company significantly. 94% of Tesla’s revenues currently stem from auto-manufacturing, economic factors that influence the EV industry will influence Tesla. For the following reasons Tesla will be impacted by coming macroeconomic changes.

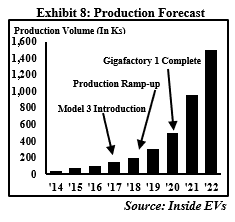

Lithium-ion Batteries Cost: One of these factors is the price and availability of lithium batteries. Exhibit 9 shows the expected growth of the global lithium-ion battery market size. As the supply increases, the price and therefore the cost of producing electric vehicles will decrease. It is estimated that the average lithium battery prices will fall by 70 % between 2020 and 2030. With its Gigafactories and research and development, Tesla understands that battery supply will need to keep up with its vehicle manufacturing. Through use of its Gigafactories and technological know-how, the company will expand its lithium-ion production.

Oil Prices: Electric Vehicles are a substitute for traditional gas-fueled cars. The price of gasoline highly correlates with oil prices, because it is a refined form of oil, and as a consequence, when oil prices increase, so does the price of gasoline. If prices of gasoline increase, the cost of driving an electric vehicle decreases relatively to the cost of driving a gasoline or diesel-powered car. Goldman Sachs predicts oil prices to peak in 2024, which would further increase demand for fully electric vehicles.

Accessibility of Charging Stations: In order for demand for electric vehicles to continue to increase, it needs to be convenient to drive them. One potential issue could be a lack of charging stations. People know that most of the time they will be able to find a gas station and fill up their car within a convenient time. The amount of charging stations and the time it takes to charge an electric vehicle will affect the rate at which electric vehicles are demanded in the future. Not only car-manufacturers like Tesla are building charging stations, but big oil companies have started to realize that electric vehicles are the future and in order to stay competitive, they will have to adjust. Royal Dutch Shell for example has already started to construct charging stations in the Netherlands and United Kingdom. The oil giant will have invested $1 billion on new charging stations by the end of the decade.

International Trade Restrictions: China and India will be the first and third largest EV markets by 2020 and both countries have governments that have a reputation for imposing barriers to entry for foreign competitors. The United States is currently the second largest market for electric vehicles and both manufacturers in Europe and the United States are able to produce higher quality vehicles than manufactures in China and India. As a result, if China and India decide to be more welcoming to foreign competitors, international trade can spur the growth of the global EV industry. European and American car manufacturers will be able to supply electric vehicles that Chinese and Indian consumers demand but currently don’t have access too. As stated earlier in the report, both the Chinese and Indian government have already shown signs that point at weakening rules for local market penetration by foreign competitors.

Industry Analysis

Tesla operates in multiple industries because strictly speaking it is both an auto-manufacturer as well as an energy company. The industries that Tesla operates in can be broken down further by geography, as Tesla’s revenues from international sources make up 40% of its total revenue. For this reason, I divided the industry analysis in two parts: automotive and energy generation and storage.

United States: The automotive market in the United States is matured and highly competitive. Many large, established manufacturers such as Ford and GM have the resources and accessibility to technology and talent required to move into the EV industry if they wish. These automotive giants realize that they will not be able to compete in the future without offering fully electric vehicles. Perhaps this is the result of Tesla’s rising popularity. The result is that the EV industry will be highly competitive in the United States. A complete analysis of Tesla’s competitive positioning will follow the industry analysis. Besides market structure, there are political issues that affect the EV market. The IRS offers a tax credit of a minimum of $2,500 up to $7,500 for each electric vehicle purchased. This tax credit will continue to be in effect until 250,000 electric vehicles have been sold by each manufacturer. Additionally, the Department of Energy has promised guaranteed loans of $4.5B for the construction of charging stations. Even though this is not a direct subsidy to EV manufacturers, it shows that the U.S. government tries to accelerate the transition to sustainable transportation. Additional tax credits and subsidies might be provided by state governments. Another factor to consider in the United States is the current government. President Trump is adamant about large tax cuts. There is a healthy skepticism about some of Mr. Trump’s tax plans which have been expected to cost between $3 trillion and $7 trillion over a decade. Members of the Senate Budget Committee have agreed on a budget that allows for a $1.5 trillion tax cut over the next 10 years however. This would have a significant positive impact on disposable income which would be favorable for manufacturers of new EV models.

China: The Chinese government has set a target for the EV industry. The target is for EV sales to make up 20% of total car sales by 2025. Even though China has the reputation of being an export-focused industry by keeping production costs low and discouraging foreign investment into Chinese industries, this time could be different. Foreign companies were already allowed to set up 100 percent-owned motorcycle and battery manufacturing operations in China beginning in July 2016 and the government is actively working out a plan to allow foreign electric vehicle manufacturers to fully own and operate subsidiaries in China. In addition, the Chinese Ministry of Commerce has said that it will “actively implement the opening up of the new-energy manufacturing sector to foreigners, together with other departments under the direction of the State Council” (Bloomberg). If the Chinese government does indeed open up the EV market to foreign competitors, it will expose consumers to more variety, higher quality cars, and it will expose the industry to technology and manufacturing processes that might not have been developed in China yet. By doing so, it will move China closer to reaching the goals it has set for its EV industry.

The EV industry analysis focuses primarily on demand of electric vehicles. That is because the policies and social developments in the industry affect demand of electric vehicles mainly. The other side of the equation, the supply side, depends on how quickly EV manufacturers can develop new models and new examples of those models.

Energy Generation and Storage: According to a report from Transparency Market Research (TMR), the Lithium-ion Battery Market is poised to rise from US$29.68B in 2015 to US$77.42B in 2024, registering a strong CAGR of 11.6% therein. A growing shift toward sustainable clean fuels in the automotive sector is a key factor driving the lithium-ion battery market. TMR finds that the demand for high power capacity batteries for automobiles has gained precedence in recent years with the rising usage of these batteries in EVs. “The increasing level of awareness among consumers and automobile manufacturers alike regarding the benefits of clean fuel, the declining availability of natural resources, and the soaring prices of fossil fuels have warranted the need for alternate solutions and this has significantly driven the global lithium-ion battery market,” the author of the report states. The market is also fueled by the rising demand for smartphones and other consumer electronics, TMR finds. Similarly to the EV industry, some companies engaged in energy storage can benefit from certain tax credits. For example, energy storage systems that are charged using solar energy are eligible for the 30% tax credit.

Solar energy ranked as the number 1 source of new capacity additions, largely due to the double-digit-gigawatt wave of utility solar power installations that came online amidst prior uncertainty over the extension of the 30% Federal Investment Tax Credit. The 30% tax credit applies to homeowners and taxpayers who own residential or commercial solar energy systems as long as the construction of the system commences before December 31, 2019. Tax credits like these are expected to fuel growth in the industry. Total installed U.S. solar system capacity is expected to nearly triple over the next five years according to the Solar Energy Industry Association.

Competitive Positioning

Tesla might be an energy company according to its CEO, Elon Musk, but currently auto-manufacturing and sales make up the largest percentage of Tesla’s revenue by far. For this reason and because the auto industry is the most competitive of all industries that Tesla operates in, most of the competitive analysis will consist of the automotive portion of Tesla’s operations. Following the automotive portion, I will briefly discuss the competitive landscape of the energy generation and storage segments.

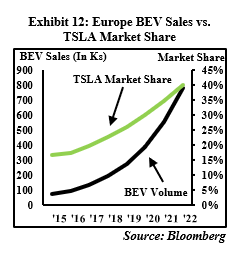

Automotive: Tesla’s current automotive market share calculated over 2017 YTD in the United States is 45%. In Europe, that number was approximately 9% by the end of Q2, 2017. In China, the EV market is dominated by Chinese manufacturers. Foreign car makers make up only 6% of the Chinese industry with Tesla making up the majority of that 6%. The competitive analysis will consist of two parts: (1) an analysis of the American and European market, and (2) an analysis of the outlook of the competitive environment in China. Measured by make, Tesla is the car maker with the largest global market with its models making up 13.9% of global sales over Q1 2017. Second was Nissan coming in at 8.8%. Since Nissan and Renault have merged however, the Renault-Nissan alliance is the company with the largest global market share. Renault-Nissan sold 29,699 fully electric vehicles in Q1 globally compared to Tesla which sold 24,071 vehicles. The market shares are computed over the entire EV industry. This includes both battery-powered vehicles such as the ones Tesla makes, as well as electric vehicles that contain a combustion engine.

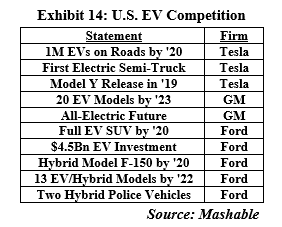

United States: Looking forward, in the U.S. market, Tesla will face competition from General Motors and Ford, which have both laid out plans to expand their EV products. GM announced early in October that they plan to have launched 20 all-electric models by 2023, including 2 in the next 18 months. Additionally, GM plans to have 10 all electric or hybrid models on the Chinese market between 2016 and 2020, including the ones already in place. Even though Tesla seems to refuse to enter a joint venture in China and tries to penetrate the market on its own, maintaining 100% control and ownership of its operations, GM would manufacture and sell their models through their joint venture with SAIC, its Chinese counterpart. GM’s electric vehicles will have self-driving capabilities to compete with Tesla’s autopilot. Ford openly declared that it will face Tesla as a competitor in the EV industry by setting up a group called ‘Team Edison’ to boost Ford’s efforts to conquer a share in the EV market. As Thomas Edison and Nikola Tesla were famously embroiled in a heated rivalry, so does Ford regard its competition with Tesla. Ford has budgeted a $4.5B investment over the next 5 years to spearhead their EV segment. Ford has already promised 13 new hybrid or all-electric models to come out within the next five years. Ford is trying to develop their EV operations primarily in segments of the auto industry where the company already has a large presence, such as SUVs and light trucks. Both GM and Ford are established auto-manufacturers with the resources to move into the EV industry and be a noticeable competitor of Tesla.

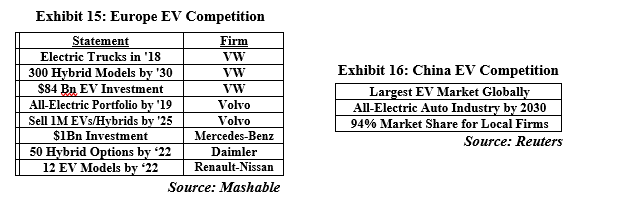

Europe: In the European market, the Renault-Nissan alliance is the only competition Tesla faces, but it is fierce. Tesla has a relatively small market share in Europe (9%). In comparison, the Renault-Nissan alliance has a 19% in the European fully EV market. I predict Tesla’s market share in Europe to increase if Tesla can manage to ramp up its production of Model 3 in the short term. Renault-Nissan produces small cars for the mass market, demand in Europe for these cars is higher compared to luxury vehicles or large American-style vehicles. Since the Model 3 is more compact than the Model S or Model X and since it is designed for the mass market, I believe it will be a growth factor for Tesla’s market share in Europe. The competition plans to grow out its EV production as well, as in September 2017 Nissan and Renault announced that, together, they would launch 12 new all-electric vehicles by 2022. Their goal is for one of these models to have a driving range of 373 miles on one charge, which would be 60 miles farther than Tesla’s most efficient model available today. In order to stay competitive with Tesla’s autonomous driving system, the Renault-Nissan group plans to develop a “highly autonomous drive [electric] vehicle for use on highways” (CNN). Furthermore, BMW has announced that they will have 12 full electric vehicles on the market by 2025. BMW is capable of manufacturing luxury vehicles and will be an important competitor of Tesla once it starts producing high quality all-electric vehicles. As in the U.S. market, auto-manufacturers are increasingly focusing on compelling EV products, making the EV landscape more competitive.

China: The Chinese EV market is still highly protected by its government and 94% of the market is captured by local manufacturers. Tesla makes up 4% of the 6% captured by foreign manufacturers. BMW makes u 1% of the Chinese EV market, and the last 1% is made up by all other foreign car makers. Local electric vehicles in China are inferior to Tesla’s models or other Western car manufacturers. The market leader in China only has a range of 100 miles on one battery. It doesn’t go faster than 78 mph and needs 13 seconds to accelerate from 0 to 60 mph. The Tesla Model 3 has a range of 220 miles, can reach 130 mph, and it accelerates from 0 to 60 mph in 5.7 seconds. The Chinese market leader competes on price as it costs approximately $19,000. The Model 3 costs $35,000 but it will be the only high quality all-electric vehicle on the Chinese market. The Chinese government has required foreign competitors to enter into joint ventures with local companies if they plan on operating in the Chinese market. The Chinese government is now discussing plans to allow foreign auto manufacturers to fully own subsidiaries in Chinese free trade zones. Analysts have predicted that revenue from China will be Tesla’s biggest source of revenue if the government allows Tesla to sell its models straight to the Chinese consumer market.

Automobile manufacturers realize that fully electric and self-driving vehicles will be the future in the industry. As a result, the biggest players in the auto industry as a whole are investing heavily in technologies that will drive growth in the electric and self-driving segments. This means that Tesla will face more competition. It also means that awareness of the EV market increases rapidly, turning it from a niche market with a 1% penetration of the total automobile industry into a mass market. Tesla started this trend and as the company is ramping up production for Mo del 3, a strong growth of EV awareness can prove beneficial.

Energy Generation and Storage: The global lithium-ion batteries market is highly consolidated with the leading three companies accounting for 57% of the market in 2016, Transparency Market Research (TMR) states in its new research report. These three companies are: Panasonic Corporation, LG Chem Power Inc., and Samsung SDI Co. Ltd. Leading players in the market are primarily located in Asia. Batteries and electric transmission account for about 40 percent of passenger cars’ costs. Tesla was the first auto manufacturer to build its own battery factory (Gigafactory 1) to satisfy demand for the cars it produces. Tesla recently won a contract to build the world’s largest lithium-ion power system in the world. It will be built in Australia. Tesla’s solar system segment faces competition primarily from Vivint Solar Inc., Sunrun Inc., Trinity Solar, Sungevity Inc., and many other local solar companies. In general it are local utility companies that supply energy to potential customers of Tesla. Tesla aims to outperform these local companies based on price, predictability of price and convenience of switching to electricity generated by its solar energy systems instead of fossil fuel based options.

Competitive Positioning

Tesla might be an energy company according to its CEO, Elon Musk, but currently auto-manufacturing and sales make up the largest percentage of Tesla’s revenue by far. For this reason and because the auto industry is the most competitive of all industries that Tesla operates in, most of the competitive analysis will consist of the automotive portion of Tesla’s operations. Following the automotive portion, I will briefly discuss the competitive landscape of the energy generation and storage segments.

Automotive: Tesla’s current automotive market share calculated over 2017 YTD in the United States is 45%. In Europe, that number was approximately 9% by the end of Q2, 2017. In China, the EV market is dominated by Chinese manufacturers. Foreign car makers make up only 6% of the Chinese industry with Tesla making up the majority of that 6%. The competitive analysis will consist of two parts: (1) an analysis of the American and European market, and (2) an analysis of the outlook of the competitive environment in China. Measured by make, Tesla is the car maker with the largest global market with its models making up 13.9% of global sales over Q1 2017. Second was Nissan coming in at 8.8%. Since Nissan and Renault have merged however, the Renault-Nissan alliance is the company with the largest global market share. Renault-Nissan sold 29,699 fully electric vehicles in Q1 globally compared to Tesla which sold 24,071 vehicles. The market shares are computed over the entire EV industry. This includes both battery-powered vehicles such as the ones Tesla makes, as well as electric vehicles that contain a combustion engine.

United States: Looking forward, in the U.S. market, Tesla will face competition from General Motors and Ford, which have both laid out plans to expand their EV products. GM announced early in October that they plan to have launched 20 all-electric models by 2023, including 2 in the next 18 months. Additionally, GM plans to have 10 all electric or hybrid models on the Chinese market between 2016 and 2020, including the ones already in place. Even though Tesla seems to refuse to enter a joint venture in China and tries to penetrate the market on its own, maintaining 100% control and ownership of its operations, GM would manufacture and sell their models through their joint venture with SAIC, its Chinese counterpart. GM’s electric vehicles will have self-driving capabilities to compete with Tesla’s autopilot. Ford openly declared that it will face Tesla as a competitor in the EV industry by setting up a group called ‘Team Edison’ to boost Ford’s efforts to conquer a share in the EV market. As Thomas Edison and Nikola Tesla were famously embroiled in a heated rivalry, so does Ford regard its competition with Tesla. Ford has budgeted a $4.5B investment over the next 5 years to spearhead their EV segment. Ford has already promised 13 new hybrid or all-electric models to come out within the next five years. Ford is trying to develop their EV operations primarily in segments of the auto industry where the company already has a large presence, such as SUVs and light trucks. Both GM and Ford are established auto-manufacturers with the resources to move into the EV industry and be a noticeable competitor of Tesla.

Europe: In the European market, the Renault-Nissan alliance is the only competition Tesla faces, but it is fierce. Tesla has a relatively small market share in Europe (9%). In comparison, the Renault-Nissan alliance has a 19% in the European fully EV market. I predict Tesla’s market share in Europe to increase if Tesla can manage to ramp up its production of Model 3 in the short term. Renault-Nissan produces small cars for the mass market, demand in Europe for these cars is higher compared to luxury vehicles or large American-style vehicles. Since the Model 3 is more compact than the Model S or Model X and since it is designed for the mass market, I believe it will be a growth factor for Tesla’s market share in Europe. The competition plans to grow out its EV production as well, as in September 2017 Nissan and Renault announced that, together, they would launch 12 new all-electric vehicles by 2022. Their goal is for one of these models to have a driving range of 373 miles on one charge, which would be 60 miles farther than Tesla’s most efficient model available today. In order to stay competitive with Tesla’s autonomous driving system, the Renault-Nissan group plans to develop a “highly autonomous drive [electric] vehicle for use on highways” (CNN). Furthermore, BMW has announced that they will have 12 full electric vehicles on the market by 2025. BMW is capable of manufacturing luxury vehicles and will be an important competitor of Tesla once it starts producing high quality all-electric vehicles. As in the U.S. market, auto-manufacturers are increasingly focusing on compelling EV products, making the EV landscape more competitive.

China: The Chinese EV market is still highly protected by its government and 94% of the market is captured by local manufacturers. Tesla makes up 4% of the 6% captured by foreign manufacturers. BMW makes u 1% of the Chinese EV market, and the last 1% is made up by all other foreign car makers. Local electric vehicles in China are inferior to Tesla’s models or other Western car manufacturers. The market leader in China only has a range of 100 miles on one battery. It doesn’t go faster than 78 mph and needs 13 seconds to accelerate from 0 to 60 mph. The Tesla Model 3 has a range of 220 miles, can reach 130 mph, and it accelerates from 0 to 60 mph in 5.7 seconds. The Chinese market leader competes on price as it costs approximately $19,000. The Model 3 costs $35,000 but it will be the only high quality all-electric vehicle on the Chinese market. The Chinese government has required foreign competitors to enter into joint ventures with local companies if they plan on operating in the Chinese market. The Chinese government is now discussing plans to allow foreign auto manufacturers to fully own subsidiaries in Chinese free trade zones. Analysts have predicted that revenue from China will be Tesla’s biggest source of revenue if the government allows Tesla to sell its models straight to the Chinese consumer market.

Automobile manufacturers realize that fully electric and self-driving vehicles will be the future in the industry. As a result, the biggest players in the auto industry as a whole are investing heavily in technologies that will drive growth in the electric and self-driving segments. This means that Tesla will face more competition. It also means that awareness of the EV market increases rapidly, turning it from a niche market with a 1% penetration of the total automobile industry into a mass market. Tesla started this trend and as the company is ramping up production for Model 3, a strong growth of EV awareness can prove beneficial.

Energy Generation and Storage: The global lithium-ion batteries market is highly consolidated with the leading three companies accounting for 57% of the market in 2016, Transparency Market Research (TMR) states in its new research report. These three companies are: Panasonic Corporation, LG Chem Power Inc., and Samsung SDI Co. Ltd. Leading players in the market are primarily located in Asia. Batteries and electric transmission account for about 40 percent of passenger cars’ costs. Tesla was the first auto manufacturer to build its own battery factory (Gigafactory 1) to satisfy demand for the cars it produces. Tesla recently won a contract to build the world’s largest lithium-ion power system in the world. It will be built in Australia. Tesla’s solar system segment faces competition primarily from Vivint Solar Inc., Sunrun Inc., Trinity Solar, Sungevity Inc., and many other local solar companies. In general it are local utility companies that supply energy to potential customers of Tesla. Tesla aims to outperform these local companies based on price, predictability of price and convenience of switching to electricity generated by its solar energy systems instead of fossil fuel based options.

Financial Analysis

Historical Financial Data: Before 2015 Tesla was a completely different then the as we know it today. It was solely an auto manufacturer without any clean energy solution services. The analysis of Tesla’s historical financial performance will therefore only cover the period 2015-2017.

Top-Line Growth: Up until Q3 2017, all of Tesla’s vehicle sales consisted of the Model S and Model X (after the discontinuation of the production of the Roadster prior to 2015). Vehicle volumes and sales revenue have increased every year since 2015. Tesla’s automotive sales from 2016 increased by 73% compared to 2015. The volume of vehicles increased by 50.6% over the same time period. Tesla didn’t break up its operations into automotive and energy generation and storage parts until Q4 2015. Since then, its energy generation and storage revenues have grown from $11.5 K in Q4 2015 to $286,980 K in Q2 2017, an increase of by 2394%.

Bottom-Line Growth: Since Q1 2015, Tesla has had one quarter of positive net income. The quarter with positive net income was Q3 2016. The reason that investors have been optimistic about Tesla is because the company has a promising future and its management and employees are extremely dedicated to their vision of accelerating the transmission to a more sustainable world. Tesla is valuated as a large growth company with a market capitalization of $59.32Bn. Investors expect Musk’s vision to materialize and Tesla to grow exponentially in the next five years. The R&D expense of Tesla made up almost 12% of its revenues. For GM, R&D expenses are only 5% of revenue. Tesla is investing heavily in its future, which makes it a growth stock.

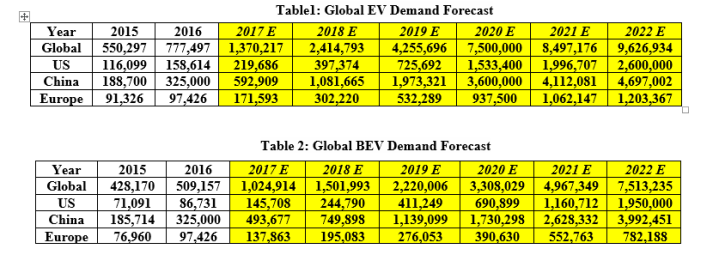

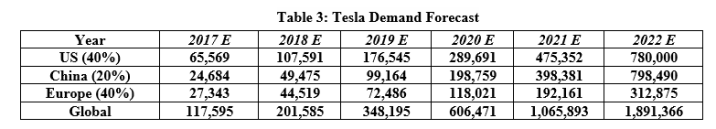

Vehicle Demand Forecast (Table 1): Global EV sales are expected to reach 14 million in the year 2025. In 2016, EV sales were 777,500. This means that EV sales will have a CAGR of approximately 38% between the end of 2016 and 2025. My estimates for the next 5 years for global EV sales can be found in table 1. These numbers include both battery powered electric vehicles (BEV) and hybrid electric vehicles which are those that still have a combustion engine.

BEV Demand (Table 2): For Tesla’s estimates, the important variable is the growth rate of sales of battery powered EVs as those are the only vehicles Tesla produces and sells. Currently, about 63% of electric vehicles sold are battery powered. With the impending decrease of price of lithium-ion batteries, I expect the share of battery powered EVs to increase sharply. The increasing amount of BEV models will also spur demand for BEVs. In 2022, I predict 75% of EVs sold to be battery powered. The implication of this is that in 2022, 7.2 million BEVs will be sold. In 2016, this number was approximately 487,000.

Tesla Demand (Table 3): Tesla currently has a 13.7% global market share and this figure is bound to increase as I expect the Model 3 to be a large growth factor in not only the United States, but especially in Europe and China. Despite increasing competition from American and European car manufacturers, my prediction is that in 2022, Tesla’s market share will have climbed to 20%, if the company can keep up with the demand for its vehicles. That means that if Tesla will be able to keep up with demand, it will sell approximately 1.45 million vehicles.

Table 3: Tesla Demand Forecast

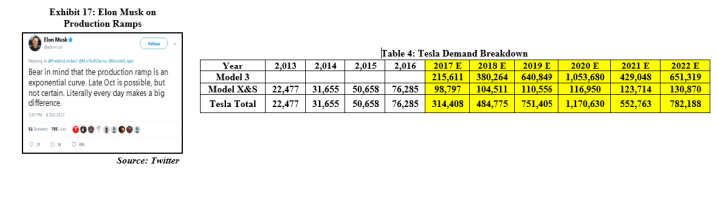

Vehicles Demand Breakdown (Table 4): The Model 3 will make up most of these sales as that is the model designed for mass adoption. Between 2014 and 2017, the combined sales of Models S and Model X sold had a CAGR of 46%. Over the last 3 quarters the Model S and Model X sales growth rate slowed down to 6% annualized. Keeping this 6% annualize growth constant until 2022 would lead to 130,870 sales of Model S and X combined in 2022. Assuming Tesla doesn’t introduce any new models between now and 2022 (which is unlikely), the company will sell approximately 1.3 million examples of the Model 3. A 6% growth rate of Model S and Model X sales is reasonable if not conservative. Cannibalization of Tesla’s older models due to the introduction of Model 3 is not a risk because the models S and X serve niche markets whereas Model 3 serves the mass market. In other words, the target group is different for all three models. Table 4 shows my expectations for demand for Tesla’s models. The assumptions I made are included in the exhibit.

Table 4: Tesla Demand Breakdown

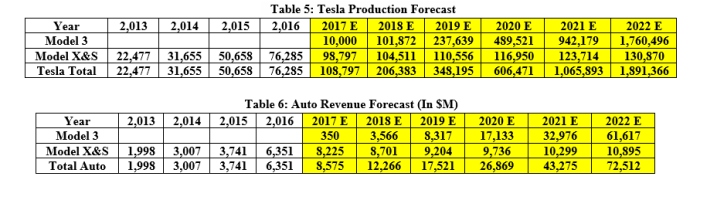

Vehicle Production Forecast (Table 5): The EV industry has a bright outlook with the BEV segment benefiting the most from the industry growth. Tesla’s market share will only increase if it is able to ramp up production fast enough to keep up with demand. Elon Musk has repeatedly claimed that Tesla will produce 5,000 units of Model 3 per week by the end of 2017. Since only 220 units of Model 3 were produced and delivered in Q3 2 017 vs a guidance of 1,500 models I don’t expect Tesla to come close to Elon Musk’s target production for 2017. It would be more realistic to expect Tesla to produce and sell 1250 units of Model 3 per week in December, which means Tesla would produce 25% of the company’s guidance. Mike Hoffman for EV Network expects October and November sales of Model 3 to be 30% and 63% of December sales respectively. Following his expectations, I expect Tesla to sell close to 10,000 Model 3 vehicles in 2017. As Elon Musk said, the production ramp is an exponential curve (exhibit 17), and once production is ramped up, the supply for Tesla’s models will be able to keep up with its demand. I expect that from 2018 onwards, Tesla is able to deliver the amount of vehicles demanded. Reasons for this expectation can be found back in some growth factors for Tesla, particularly the ‘gigafactories’. Further, the model 3 is simple and quick to produce once the bottlenecks are overcome, as Elon Musk claims that “there is nothing in the Model 3 that doesn’t need to be in there.”

Top-line Growth Vehicle Segment (Table 6): Table 4 shows the demand for Tesla’s models and Table 5 shows Tesla’s expected sales. In 2017 Tesla will not be able to meet demand for its products because of what Musk calls “the production hell” that the company currently finds itself in with regards to Model 3. Once the obstacles to ramping up production are removed, Tesla will be able to supply the quantity of its vehicles demanded. Between 2016 and 2022, I expect revenues from Tesla’s vehicle segment to increase at a 45.5% CAGR from $6350.8M in 2016 to $60,295M in 2022.

Energy Generation and Storage Forecast: Since 2015, energy generation and storage products made up between 1% in Q1 2015 and 13% in Q2 2017. The percentage of revenues made up by energy generation and storage has increased by 8% over the last 4 quarters. Until 2022 I predict this change to slow down because of the extreme future growth rate of the global EV market and Tesla’s focus on the Model 3. Therefore, I predict the percentage of business made up by energy generation and storage to grow by 6% per quarter, which is approximately 26% annually until 2022.

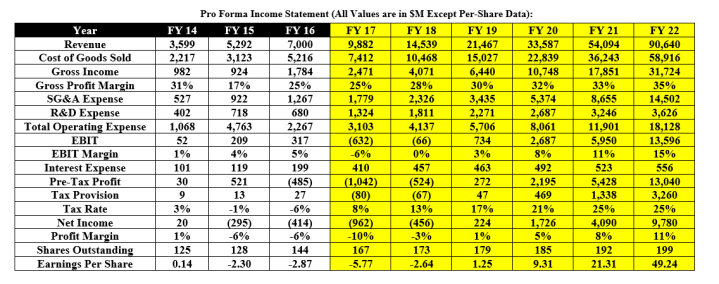

Pro Forma Income Statement

Based on the financial analysis and growth factors, the following assumptions were used to create the pro forma income statement found above:

- By 2022, battery-powered EVs will make up75% of EV sales in the U.S., 85% of EV sales in China, and 65% of EV sales in Europe.

- By 2022, Tesla will have a 40% market share in the U.S., 20% in China, and 40% in Europe.

- The percentage of Tesla’s revenue made up by its energy generation and storage segment will increase by 4% annually until 2020. Over 2020, it will increase by 2% to 25%. During 2021 and 2022, it will stay stable at 25% of revenues.

- The Gross Margin will increase by approximately 2% annually. This is attributable to growing economies of scale, increasing production efficiencies, and an increasing portion of revenue being generated by the energy generation and storage segment.

- Until 2022, R&D expenses will increase in absolute numbers but as a percentage of revenue, it will decrease from 11% in 2017 to 4% in 2022.

- The tax rate will steadily increase to 25% in 2022 to price in the risk of government tax credit programs coming to an end.

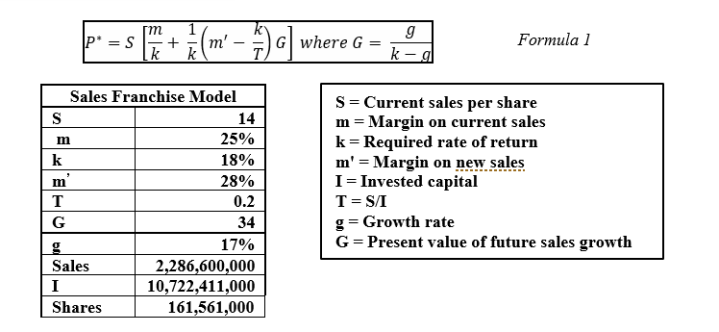

Valuation

As the ‘Risk Factor’ analysis describes, there is some uncertainty in pricing Tesla. In order to account for the various risk factors, I computed a range of valuations based on different company growth rates and required rates on return. These valuations can be found in table 7 below.

The numbers highlighted in yellow are the most accurate valuations. The most realistic valuations are those with a required rate of return of 15.5% or 16%. Normally this would be on the high end for a buy recommendation. But, for Tesla it is reasonable, because the valuation is fully based on the future performance of the company and as the risk factor analysis will point out, there are multiple uncertainties that can significantly affect that future performance. The assumption of a high growth is logical because of the coming macroeconomic changes which will increase the market penetration.

For the fair value computations I used the Sales Franchise Value Model, which incorporates the sales per share, margins on future sales, the present value of future sales growth, and invested capital. Formula 1 is the mathematical formula for calculating a share’s fair value according to the Sales Franchise Value Model. The model was useful for Tesla in particular because the company currently has negative earnings and cash flows, meaning that earnings- and cash flow-based models are infeasible if not impossible to use. The Sales Franchise Value Model also places an emphasis on a company’s future sales growth, as well as margins. For Tesla, a large growth company that will benefit from economies of scale in the future, this model will present the most accurate valuation.

Taking the average of the highlighted valuations leads to a fair value of $339, which means Tesla’s current market price of $356 is an overvaluation of 5%, which makes the company fairly valued.

Risk Factors

EV will not take-off: Tesla’s success depends largely on the success of the entire EV industry. If demand for electric vehicles, particularly battery powered electric vehicles, increases slower than forecasted, Tesla’s future revenues will be lower than expected as well. This can happen for example by oil prices staying low or government incentives for manufacturing and buying electric vehicles coming to an end. Not only would the automobile segment from Tesla struggle, the company would also risk losing its core business model since its mission is to accelerate the transition to a world with sustainable transport. 2012 was the first year in which more than 50,000 electric vehicles were sold globally. Since then, it took 5 years for the EV market to reach a 1% penetration of the global automotive market. With that in mind, Goldman Sachs’ expectation of a global penetration of 22% by 2025 is very ambitious and the real market penetration might come short of this forecast.

Competition: Most auto manufacturers realize that electric vehicles will most likely shape the future of the automotive market. The result is that the largest auto makers are heavily investing in EV technologies. That is why companies like GM, Ford, Renault-Nissan, and BMW are announcing multiple of their EV models to come out by 2020. The competition will be a threat to Tesla’s future market shares because the competition consists of well-established auto manufacturers with that have the necessary resources to develop EV technologies. Not only will Tesla face competition from these manufacturers in the United States and Europe, but as soon as China would weaken laws for foreign competitors to penetrate the Chinese markets, Tesla will have to fight its competitors on market share in China too. Furthermore, self-driving technology is another fast-growing development in the automotive industry. Tesla does have the autopilot, but that is not a full self-driving technology. Tesla plans to offer fully autonomous driving by 2019, but there is a risk that one of its competitors beats Tesla to fully autonomous driving for electric vehicles, which could potentially give them a first-mover advantage over Tesla.

Production Bottlenecks: The Tesla Model 3 is the product Tesla designed for the mass market. As expected, the announcement and first deliveries of the Model 3 led to a mass demand as Tesla has already received close to 500,000 preorders for the Model 3. The question is whether Tesla will be able to ramp up production fast enough to supply the Model 3 according to the company’s production schedule. In Q3 2017, the first full quarter of Model 3 production and deliveries, Tesla was not able to match the targets it had set out for Model 3 production. In fact, the company came 82% short of its target of 1,500 deliveries when it only delivered 270 units. The risk is that if Tesla continues to miss estimates and targets, investors and potential customers will start questioning Tesla’s ability to deliver, which will have a negative impact on TSLA returns.

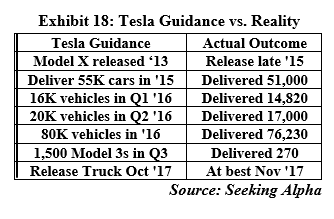

Vision never materializes: Elon Musk’s vision is to move to global sustainable transport. If either Tesla is continuously unable to deliver on Musk’s promises, or if the rest of the world does not support and buys into his vision, Musk’s ideas will not become reality and the fundamental business concept of Tesla will become invalid. Exhibit 18 shows a couple of Tesla’s promises and the realistic outcomes of each claim. Investors are banking on Elon Musk’s and Tesla’s ability to ramp up production and keep up with global demand for its battery powered EVs. This is why Tesla is the second-largest car manufacturer in the world by market cap while not nearly producing as many vehicles as its peer group. If Tesla’s production continuously falls short of expectations, critics will argue Elon Musk’s and his company’s credibility and investors might lose faith, causing Tesla’s stock returns to crumble.

Recommendation

My recommendation is based on the future growth rate of Tesla, not the current mispricing of the company. Therefore, the fact that Tesla is currently fairly valued according to my valuation and the valuation of other analysts which have assigned Tesla median target price of $345, should not be the deciding factor.

Recommendation: I recommend buying 225 shares of TSLA.